How Resilient is BRICS in the Storm of Geopolitics? – Part 1

Introduction

BRICS is an organization that has the potential to shift the entire economic and geopolitical balance of the world in favor of the Global South; moreover, it is fair to say that this has already occurred. This organization is a key topic of our blog. Our very first article, “The Unstoppable Rise of the East” from November 18, 2022, was dedicated to BRICS. Readers who base their worldview primarily on Western media will know little or nothing about this organization, as the West focuses on either ignoring BRICS altogether or referring to it in a condescending manner as a failed or embarrassing attempt by a few developing countries to rise above their insignificance. This is how the Collective West communicates the whole story to its own subjects. The reality, however, presents a completely different picture.

In this first part, we will compile the facts about BRICS and highlight major trends.

In the second part, we will explain why we believe that storm clouds have indeed gathered, because BRICS, or rather its members, partners, and candidates, cannot develop in peace and quiet, as did its counterpart in the Collective West, the G7, which was founded in 1975, or the World Bank, which was founded in 1944. Their counterpart was only launched in 2014 and is called the New Development Bank, and it must hold its own in turbulent times.

In the third and fourth part, we will then attempt to show where this organization could be headed and what can be expected from the Collective West in terms of attempts to prevent this.

Where does BRICS Stand Today?

Difficult Information Gathering – “Fog of War”

It has always been difficult to obtain accurate data on members, partners, and candidates, which is probably one reason why we are the only blog we know of that has undertaken this enormous task. Our Denis Dobrin tirelessly scours the internet to extract reliable information for us from a jumble of the usual gossip and rumors.

A “fog of war” has descended on key information about this organization.

At present, however, it appears that this information is being deliberately kept even more vague than before, as the official BRICS website is even more reticent with information than in the past. This is a clear indication that many parties considering joining are pursuing a very cautious information policy for fear of American repression and aggression. This is a new phenomenon for an economic alliance in our time. Let's call a spade a spade: a “fog of war” has descended on key information about this organization.

For this reason, the following information should be understood as “best effort,” i.e., we confirm that we have made every effort to obtain the correct information, but cannot provide any guarantee.

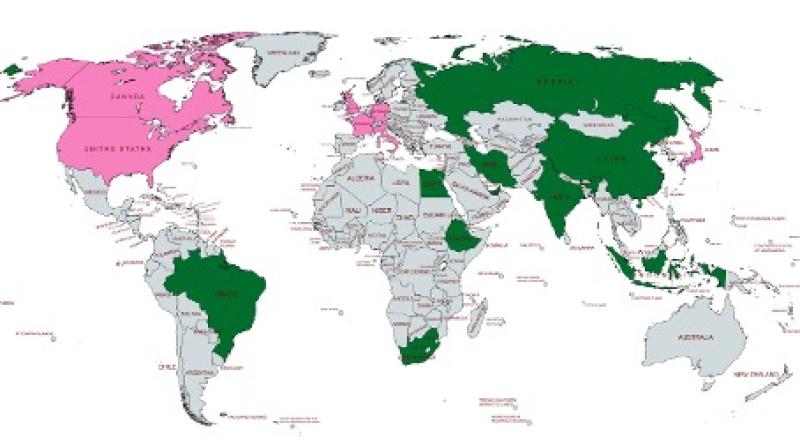

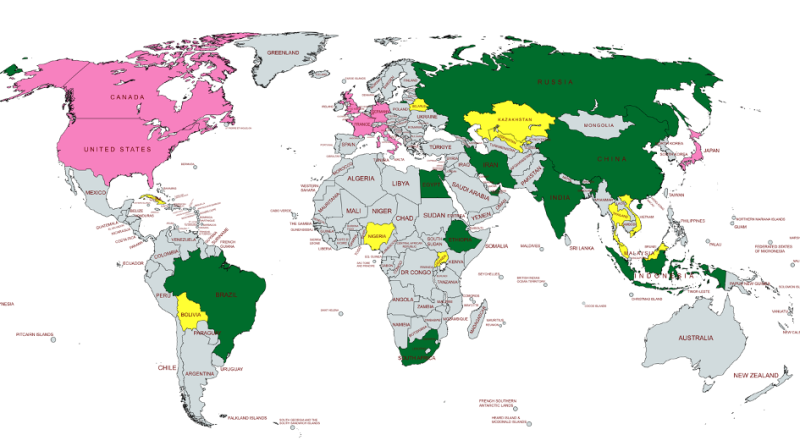

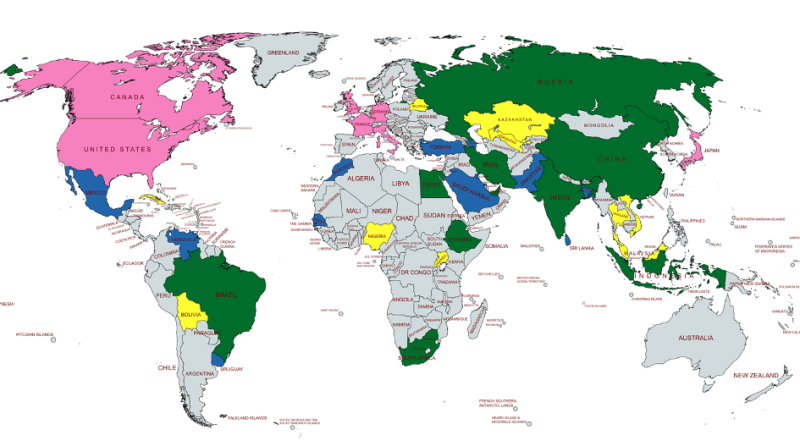

Members

BRICS currently has 10 full members. Indonesia was newly admitted as a full member on January 6, 2025. Indonesia is hardly noticed in the West. This huge country (1,905,000 km²) is more than five times larger than Germany (357,022 km²) and its population (285 million) exceeds that of Germany (83 million) by a factor of 3.5.

Partners

Partner status was created at the 2024 BRICS summit in Kazan. It is not a second-class membership. BRICS covers not only economics, but also culture, education, research, relations between peoples, and women's rights. During 2024, when Russia held the presidency, over 200 sub-conferences on BRICS were held in Russia. This represents a huge effort to create a common course at various levels among very heterogeneous peoples. Partner status can thus be described and understood as a antechamber to full membership. Countries with partner status exchange ideas with full members in the antechamber and coordinate in order to then jointly achieve full membership.

I assume that countries that achieve partner status already maintain closer and more advantageous economic relations with full members during this status.

Candidates

The list of candidates should be treated with caution due to the fog of war argument. Rumor has it that there are numerous other countries—not appearing on the list—that did not want to attract attention for fear of repression from the Collective West.

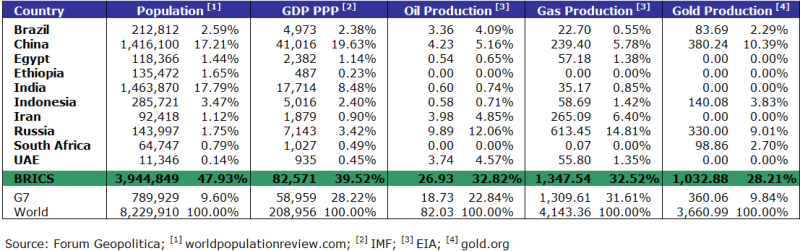

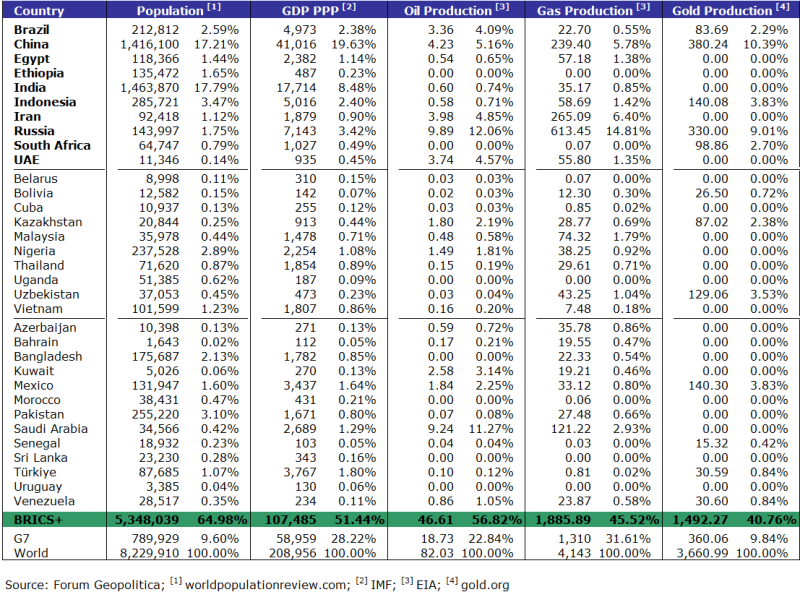

Classification of Numbers

Population Figures

The Collective West accounts for approximately 10% of the world's population and thus more or less controlled the rest of the world for centuries, first through the Portuguese, then the Spanish, Dutch, French, British, and now the US.

The part of the world we call the Global South accounts for approximately 90% of the world's population and no longer wants to be dominated by the 10% – this is probably one of the main reasons why BRICS is developing so rapidly. In the past, the dominance of the West was possible, to put it simply, because the Global South was unable to defend itself militarily, as social cohesion was lacking, often due to a lack of education, and this part of the world did not dare to rebel against these superhumans in the first place. That has now changed completely. American universities still top the rankings, for example in university rankings, but this is mainly because these rankings are compiled in the West – paper is patient. If the quality of the results – for example in science – were included as a criterion, universities from the Global South (China, India, Russia) would probably be very well represented in the rankings.

Gross National Product

We show gross national product adjusted for purchasing power parity. Using the US dollar as a benchmark for GDP distorts a country's economic strength: if you want to measure financial clout realistically, it matters greatly whether, for example, a Big Mac costs twice as much in US dollars in one place as it does elsewhere. The so-called Big Mac Index is reason enough to use purchasing power-adjusted figures when comparing GDP figures. The reason why Western media use unadjusted figures is purely for marketing purposes, to conceal the devaluation of the US dollar and make it appear stronger than it is.

Oil Production

When evaluating oil production figures, the following additional facts should be taken into account:

Firstly, although the US is still the world's largest oil producer, accounting for around 18% of global production, it also consumes the most oil, accounting for over 20% of global consumption. This means that the US is currently not even able to cover its own consumption. This circumstance alone is a compelling reason for the US to put pressure on Saudi Arabia, for example, to prevent it from joining BRICS.

Secondly, the major oil-producing members of BRICS have a great deal of influence over, or even control of, OPEC. Since BRICS also dominates OPEC and thus controls the price and distribution of a large part of the oil, one can speak of an (indirect) monopoly position of BRICS.

Thirdly, the production costs for US oil are several times higher than the production costs in BRICS countries.

These factors further strengthen BRICS' position of power with regard to oil.

Natural Gas

With regard to natural gas, it should be noted that with Iran's accession to BRICS, the world's two largest natural gas producers are both members of BRICS: Russia and Iran.

The largest non-BRICS gas producer is Qatar, which is (still) allied with the US. BRICS is therefore also a real power center in terms of natural gas.

Gold

In the past, we were ridiculed on several occasions for including gold production in the table of important commodities. Today, however, it is clear that gold—and silver too—will not only be important in the unstable environment of financial markets and fiat currencies, but will also be strategically indispensable for the survival of all economies.

Further Data

Special Thanks to Simon Hunt

While writing this article, I consulted with my close friend Simon Hunt and asked him for more data—for which I thank him warm.

Dynamics of Future GDP Development

The GDP of the BRICS countries is expected to grow by an average of 3.8% this year and by a further 3.7% by 2026 (World Bank).

For the fundamental problems with GDP as a reliable measure of value creation, I refer you to Tony Deden's excellent article “The Illusion of Progress.”

In contrast, the real GDP of the G7 countries is expected to grow by 1.0% this year and by 1.2% by 2026 (World Bank).

If we assume that the real GDP of the BRICS countries will grow by an average of 3.5% until 2032 and the average GDP of the G7 countries by 2% per year, we arrive at the following conclusion.

2025 | BRICS 100.00 | G7 100.00 |

2026 | 103.50 | 102.00 |

2027 | 107.12 | 104.04 |

2028 | 110.87 | 106.12 |

2029 | 114.75 | 108.24 |

2030 | 118.77 | 110.41 |

2031 | 122.93 | 112.62 |

2032 | 127.23 | 114.87 |

This would result in a 27% increase in the GDP of the BRICS countries and only a 14% increase in that of the G7. However, this exercise in figures is only intended to serve as an illustrative example of the greater dynamism of the BRICS countries, since such an extrapolation of economic growth assumes that the membership of BRICS will remain unchanged until 2032 and that the overall dynamics of economic development will not change, which I consider highly unlikely.

This view is confirmed by Bloomberg:

Other Commodities and Industrial Production

According to Simon Hunt's research, the share of global raw materials, in addition to those listed in our tables, is very impressive. For example:

70% of global coal production

72% of global reserves of rare minerals (including processing)

42% of global wheat production

52% of global rice production

43% of global corn production

Hunt estimates that BRICS countries currently account for 38% of total industrial production.

Financial Facts of BRICS

New Development Bank – “BRICS Bank”

It is headquartered in Pudong, China. The current president is Ms. Dilma Rousseff, the former president of Brazil, who is competently supported by four vice presidents and around 300 employees.

The bank has an authorized initial capital of US$100 billion, of which US$10 billion is contributed in equal shares by the five founding members. The callable capital amounts to US$40 billion, which the members must provide when needed to meet financial obligations.

The United Arab Emirates joined the bank in 2021.

A formal operational and administrative structure has been established. The administration operates in a very conservative manner. For example:

The minimum capital ratio is set at 25%, but stood at 37% at the end of 2024.

The minimum liquidity ratio is 100%, but stood at 149% at the end of 2024.

The maximum capital utilization is 90%, but stood at 16% at the end of last year.

The bank was recently authorized to repay loans in local currencies. The ultimate goal is for the BRICS bank to become the primary source of credit for member countries, thus replacing the World Bank and the IMF. This new policy is consistent with the development of trade and investment within the BRICS community, which is to be conducted in local currencies and, ultimately, when finally structured in the new BRICS currency, backed by gold.

This will likely be done through the Shanghai Gold Exchange (SGE), which is building gold vaults in member countries. A new gold facility has been created in Hong Kong, and the SGE is nearing completion of a gold vault in Saudi Arabia. Saudi Arabia has a trade surplus of about $20 billion with China. Currently, oil sales to China are paid for in yuan, which Saudi Arabia can currently exchange for gold in Shanghai if it wishes. In the future, the exchange will take place at the SGE in Saudi Arabia. Thus, gold is the intermediate value, not the dollar. This is the plan for all BRICS members and partners.

The expansion of the Chinese Cross-Border International Payments System (CIPS) is linked to the developing BRICS currency system. Currently, 189 countries are participating in the system. According to the PBOC, more than 4 million transactions worth US$12.7 trillion were processed in the first half of 2025, many of which were carried out within the BRICS countries.

The Trend Away from the US Dollar and Toward the Renminbi

The use of the US dollar as a weapon is increasingly leading to a decline in the use of the US dollar as a reserve currency.

The US has used the US dollar as a weapon for decades, cutting off countries, companies, and individuals from US dollar trading if, in the US's sole opinion, they did not act in accordance with US interests. The straw that broke the camel's back was definitely the freezing and subsequent theft of Russia's foreign exchange reserves. The BRICS members now saw that the US could devastate any country with the stroke of a pen, demonstrating that holding US dollars is a risky and dangerous undertaking in today's geopolitical situation.

The response from countries in the Global South—not just BRICS—was prompt, as the following chart from Bloomberg shows:

Added to this is the ongoing devaluation of the US dollar. In 1971, an ounce of gold cost US$35; today, the price is US$4100. The US dollar has thus lost 99% of its value compared to gold.

Russia was initially the trendsetter, switching from the US dollar to the renminbi due to sanctions.

Several African countries have thus begun converting their US dollar-denominated debt into Chinese yuan. Kenya has completed the conversion of three Chinese loans worth around $3.5 billion. Ethiopia is currently negotiating with Beijing to convert at least part of its $5.38 billion Chinese debt into yuan-denominated loans. Other countries will follow, according to Chinascope.

According to FinanceAsia, Kazakhstan Development Bank has issued its first offshore bond in renminbi. CICC (China International Capital Corporation) acted as global coordinator for the issuance of a dim sum bond worth 2 billion renminbi with a yield of 3.35%—note the low interest rate.

Energy

We must also include the ability to provide large quantities of electrical energy among our strategic resources. This does not just mean the ability to supply industry and the population with electricity. We are focusing here on the ability of an economy to provide significant amounts of electrical energy beyond the “conventional” industrial framework, e.g., for data centers of all kinds, especially for artificial intelligence.

Here, too, the West as a whole is in a very uncomfortable position compared to China.

By shutting down and dismantling its solid nuclear power plants and turning to solar energy with almost religious fervor, Germany has put itself in an untenable position for an industrialized country. The following chart illustrates this based on import and export volumes for the year 2025 to date:

With this energy structure, Germany, currently the largest economy in the EU, will not be able to participate in the data market, which will be decisive for the future. This is because an AI center with its data centers requires enormous amounts of electricity that must be available at all times. However, with its gigantic miscalculation in the energy sector, Germany is dragging the whole of Europe down with it. And that's not even taking into account the EU's bizarre clinging to Ukraine, which is more likely to guarantee further decline than prosperity.

But the US also has noticeable problems, as a recent analysis by stock3.com shows. Referring to Goldman Sachs, it states:

"Eight of 13 regional US electricity markets are already operating at or below critical reserve levels. Effective reserve capacity in electricity generation has plummeted from 26% five years ago to 19% today, approaching the industry's emergency threshold of 15%."

It goes on to say: “Data centers already consume 6% of total US electricity demand. By 2030, this share is projected to rise to 11%, which could bring the grids to the brink of collapse.”

China, on the other hand, is reaping the rewards of a well-considered, strategic approach in this crucial area:

"China, on the other hand, is pursuing an energy offensive of historic proportions. By 2030, the Middle Kingdom will have effective electricity reserves of around 400 GW, more than three times the expected global data center demand of around 120 GW. Beijing is aggressively diversifying its energy mix and expanding capacity at a breathtaking pace."

It should also be mentioned that the energy offensive is accompanied by an equally well-thought-out offensive in the development and production of the latest semiconductors.

Interim Result

The bare figures are certainly impressive, and under normal, peaceful circumstances, the race between the Global South and the Collective West would probably already be over. There are two main players: on the one hand, BRICS as an organization whose heavyweights China, Russia, and India dictate not so much the direction of travel as the pace. On the other hand, China is challenging the US in terms of reserve currency, a trend that can no longer be ignored. However, it should be clearly stated that this will only be a prelude to a complete turnaround, as the multipolar Global South is not aiming for the renminbi as a reserve currency as its ultimate goal, but ultimately for the multipolar use of many currencies with a settlement system that will probably be based on gold. See our article from February 2025: “How BRICS could overcome its biggest challenge – payment settlement.”

In the second part, which will follow in the next few days, we will argue why we describe the current geopolitical situation as a storm that is affecting the orderly development of BRICS.

«How Resilient is BRICS in the Storm of Geopolitics? – Part 1»